how do i get a tax exempt id from home depot

To get started well just need your Home Depot tax exempt ID number. So Lets Try itHow to get Home Depot Tax Exemp.

How To Purchase From Home Depot Uf Procurement Uf Procurement

Click here for Tax Exempt Application and Tax.

. Open the form in the online editor. Here it is guys. Apply for Your Account.

Head to the Home Depot tax exempt application page and click the Register Online option. To get additional copies of this. To make tax exempt purchases.

A hold-your-hand video that will help you gain tax exemption from Home Depot. Theres also a link to a FAQ page adjacent to the registration button. Tax-exempt organizations are generally required to have and use an employer identification number EIN.

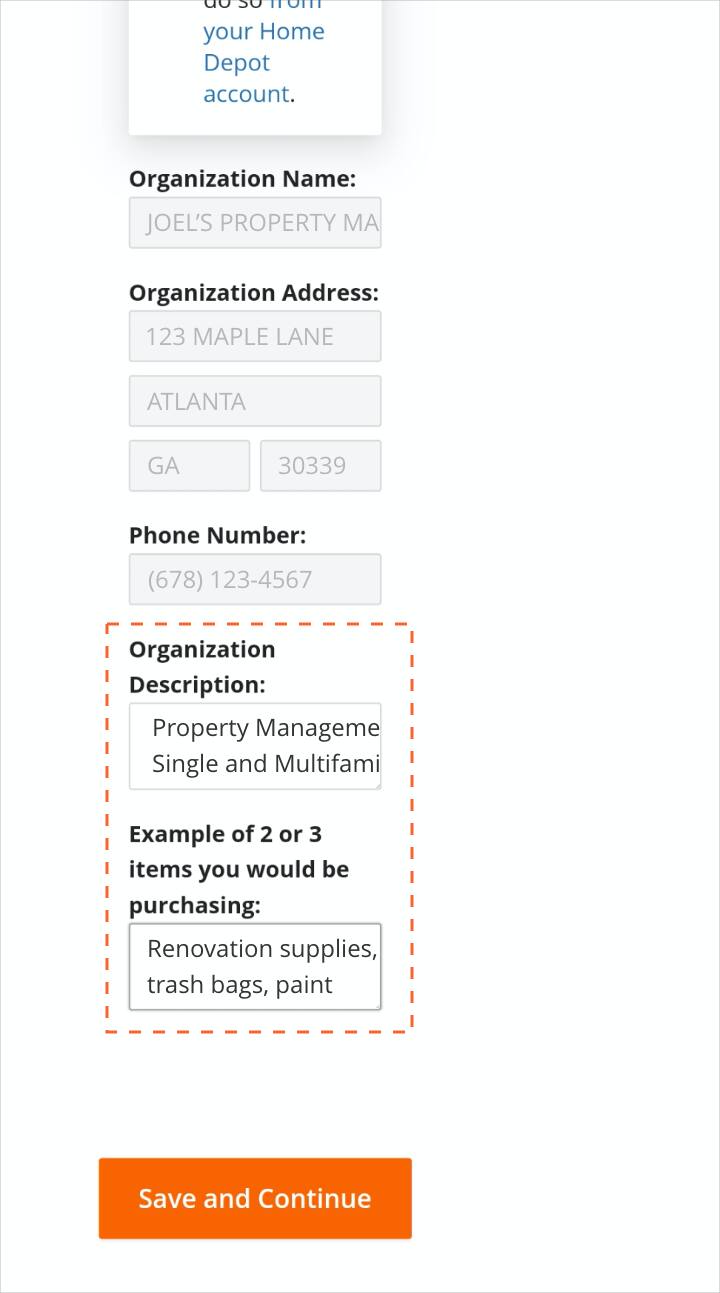

Establish your tax exempt status. Keep to these simple instructions to get Home Depot Tax Exempt ready for sending. To apply for a Tax ID you need to go to The Home Depots website here and provide the following information.

Find the document you want in our library of legal templates. Easily follow these steps and start dropshipping using Home De. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want.

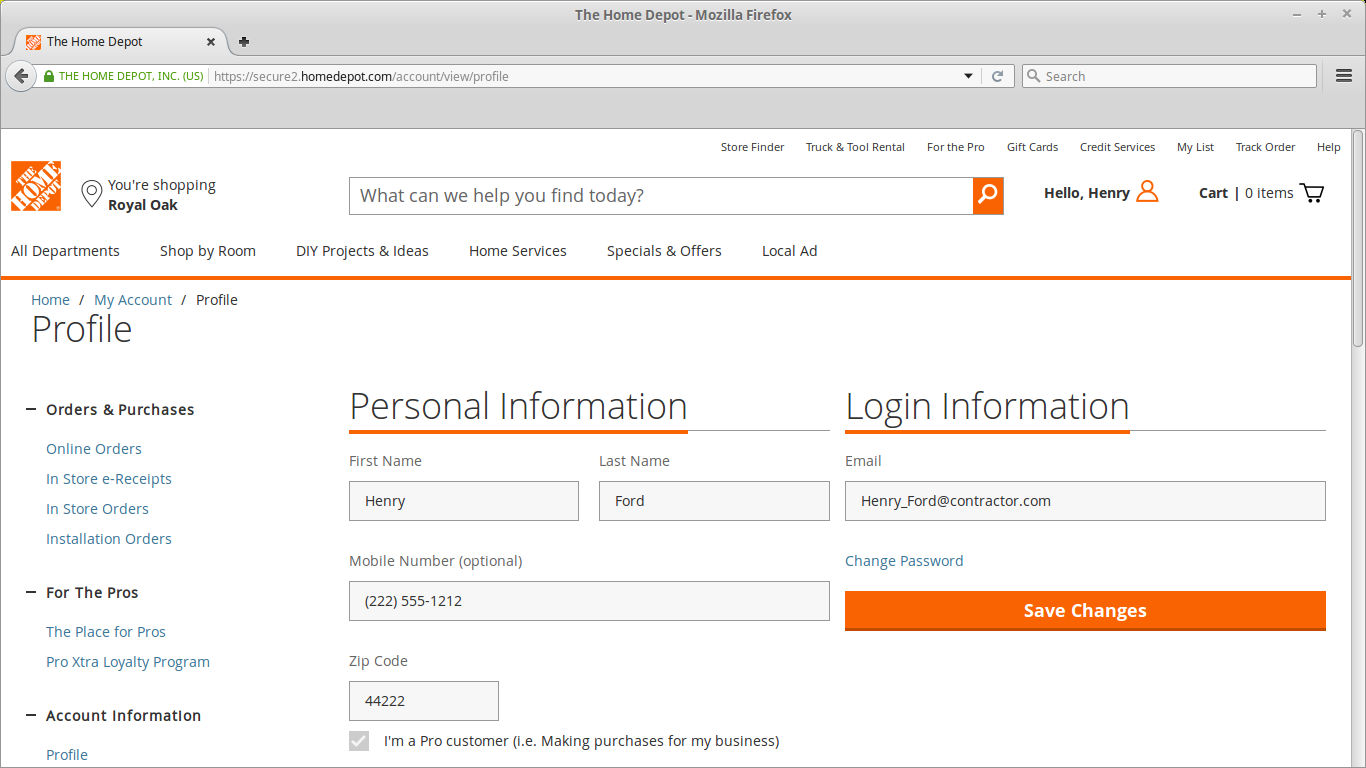

TAX EXEMPT CUSTOMERS 1. Phone number Make sure this phone number is registered to your Pro. Here you will find information that will allow you to reach the goals you have in life.

From basic office supplies such as printer paper and labels to office equipment like file cabinets and stylish office furniture Office Depot and OfficeMax have the office products you need to. Before your business can purchase products from Home Depot stores without paying sales tax however you will need to complete Home Depots online application process that registers. Go to the Home Depot Tax Exempt Registration Page in your web browser see Resources.

Complete Form ST-1191 This form is mailed with your exemption certificate and is not available on our Web site. Enter your business information and click Continue The required fields are marked. Tax-exempt organizations must use their EIN if required to file employment tax.

Up to 8 cash back View or make changes to your tax exemption anytime. Welcome to my channel. As of January 31 2020 Form 1023.

If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt. Please complete the following tax-exempt application and include any applicable state specific documentation to support your exemption.

How To Register For A Tax Exempt Id The Home Depot Pro

Automate Home Depot Pro Xtra Receipts

How To Find Home Depot Tax Id Fill Online Printable Fillable Blank Pdffiller

How To Register For A Tax Exempt Id The Home Depot Pro

How To Place A Tax Exempt Order

9 03 Home Depot Tax Exemption Youtube

The Home Depot Pro Cooperative Contract Overview

27 Best Ways To Save At Home Depot Every Time You Shop

Home Depot Donation Request Form Fill Out And Sign Printable Pdf Template Signnow

How To Register For A Tax Exempt Id The Home Depot Pro

How To Register For A Tax Exempt Id The Home Depot Pro

Can You Avoid Paying Sales Tax At The Home Depot Hammerzen

How To Register For A Tax Exempt Id The Home Depot Pro

36 Home Depot Hacks You Ll Regret Not Knowing The Krazy Coupon Lady

Tax Exempt Purchases For Professionals At The Home Depot

I Bought My Products At Home Depot And Provided A Receipt Receipt Template Credit Card App Free Receipt Template

Shop Tax Free Weekends To Save On School Supplies Krazy Coupon Lady The Krazy Coupon Lady

36 Home Depot Hacks You Ll Regret Not Knowing The Krazy Coupon Lady