santa clara property tax exemption

Parcel taxes are real property tax assessments available to cities counties. Email the Assessors Office.

Stanford Wants Educational Tax Exemption For Faculty Homes News Almanac Online

The application period for the 2022 Low-Income Senior Exemption Safe Clean Water Tax is April 15 2022 - June 30 2022.

. You may call the Assessors Office at the number below for more specific information. County Government Center East Wing 70 W. Applications for Property Tax Postponement for the 2020-21 tax year are now available.

Santa Clara California Exemption Statement - Texas. The bills will be available online to be viewedpaid on the same day. Hedding StSan Jose CA 95110-1771.

Learn Everything You Need to Know About School Parcel Tax Exemptions in Santa Clara County. Assessor Exemptions County Government Center East Wing 5th Floor 70 West Hedding Street San Jose CA 95110 Phone. Senior citizens and blind.

28 rows Cambrian Exemptions Info and Application. Owners must also be given an appropriate notice of rate. Palo Alto Exemptions Info and Application.

100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property. Exemption Division - 408 299-6460. Request the Assessor to speak.

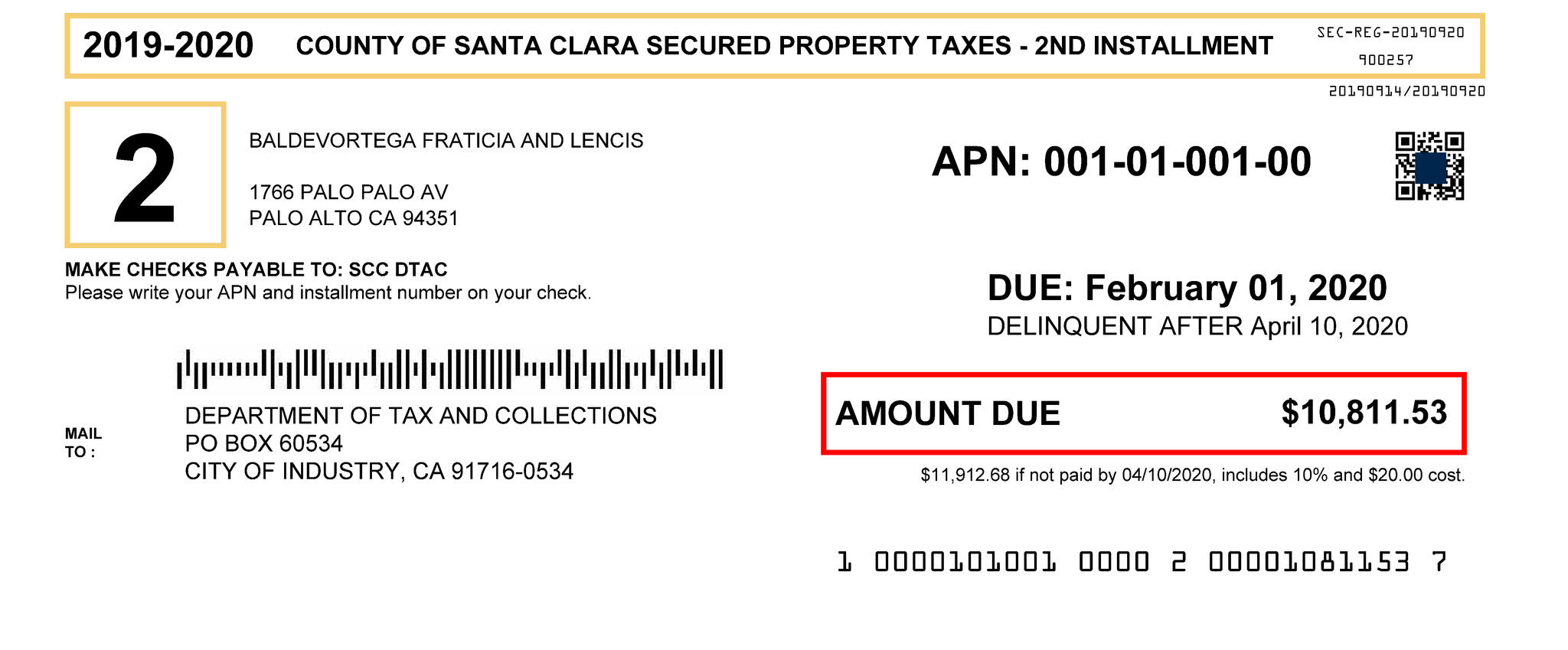

Property Tax Exemptions. APN for real property in Santa Clara. CC 1169 The document must be authorized or required by law to be recorded.

Code 27201. This translates to annual property tax savings of. Please call 800 952-5661 or email postponementscocagov if you prefer to have an application.

Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to. The tax was renewed and approved by the voters in November 2020. For More Information Please Contact.

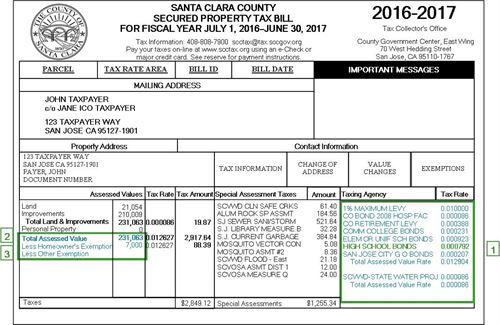

Santa Clara Valley Water District. The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence. Franklin-McKinley Exemptions Info and.

Available Exemptions Application DeadlinePeriod Renewal Website for Exemption and Application Information. The property must be located in Santa Clara County. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with. All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. Santa Clara County Property Tax Exemption Form - Santa Clara County Property Tax Exemption Form - How must a county exemption kind be filled in.

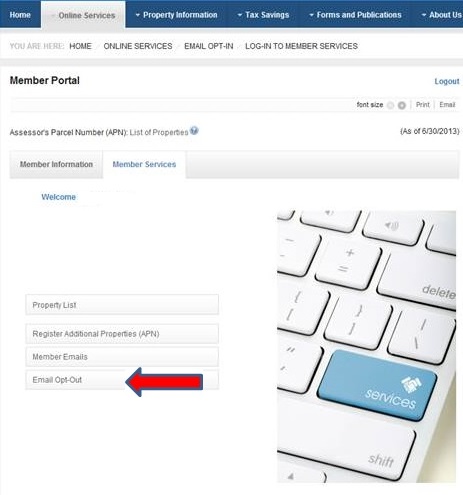

Homeowners can call the Assessors Exemption Unit at 408 299-6460 or e-mail the. The home must have been the principal place of residence of the owner on the lien date January 1st. To claim the exemption the homeowner must make a one-time filing with the county.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

Ca Santa Clara County Rfp 2017 Prison Phone Justice

How Has Prop 13 Affected Tax Distribution In Santa Clara County San Jose Spotlight

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

East Side Union High School District Bond Measure Faqs

Property Taxes Department Of Tax And Collections County Of Santa Clara

Stanford Wants Educational Tax Exemption For Faculty Homes News Almanac Online

Property Taxes Department Of Tax And Collections County Of Santa Clara

Guest View Who S Exempt From Parcel Taxes In Santa Clara County Morgan Hill Times Morgan Hill San Martin Ca

Santa Clara County Gift Deed Form California Deeds Com

Grand Jury Santa Clara County Schools Impede Tax Exemptions

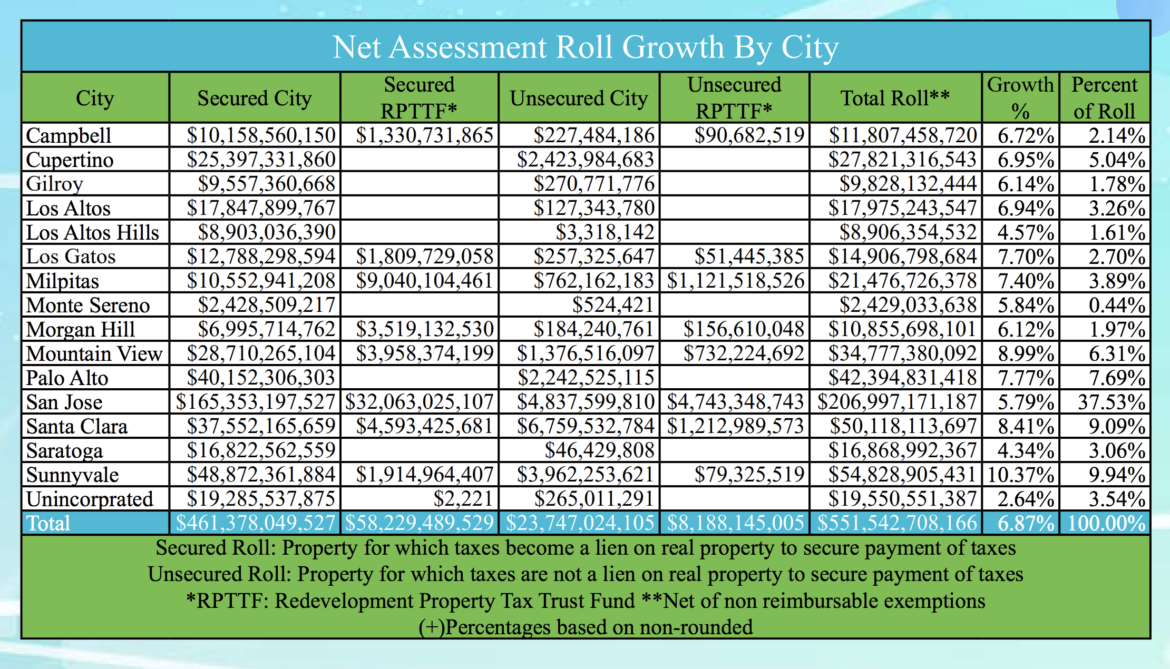

Santa Clara County S 2020 Assessment Roll Culminates Decade Of Economic Growth San Jose Inside

Low Income Seniors May Apply For Property Tax Exemption Santa Clara Valley Water

Propositions 13 And 8 Santa Clara County Property Tax Propositions California Real Estate Tax Realty Times

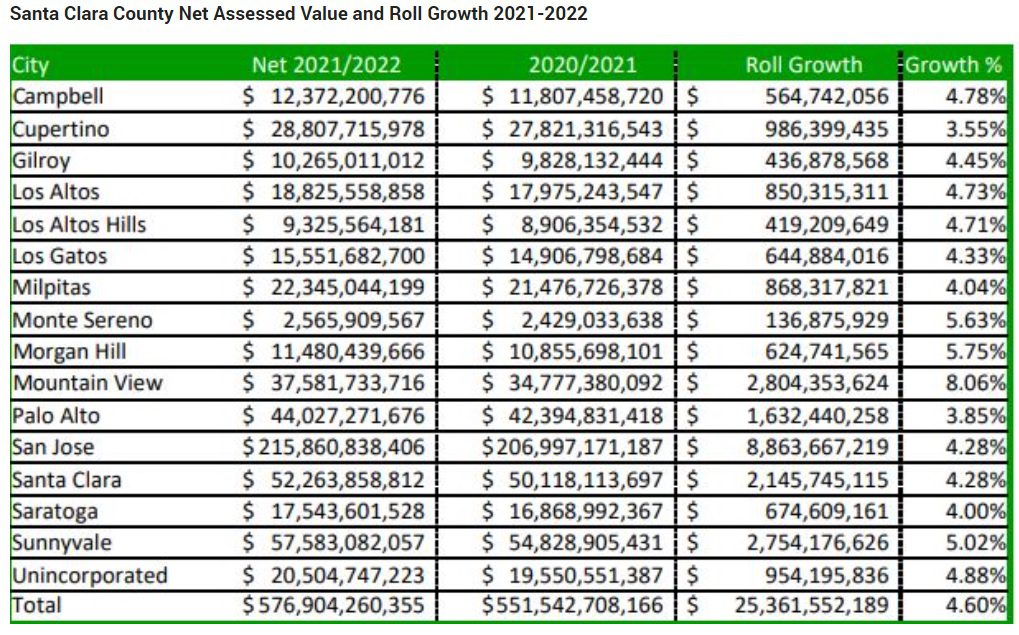

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight